|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

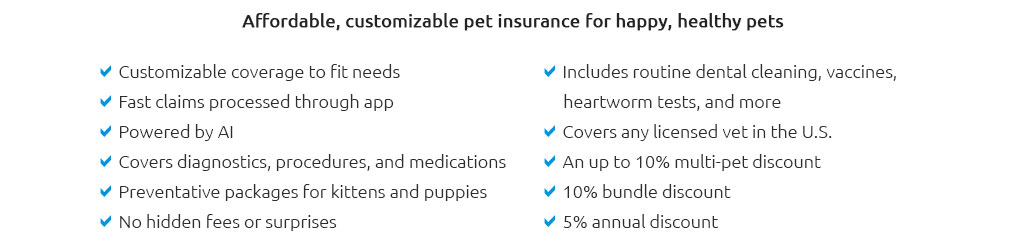

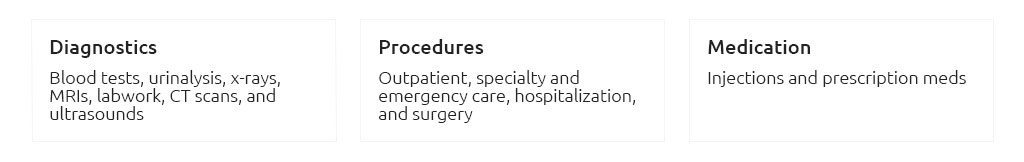

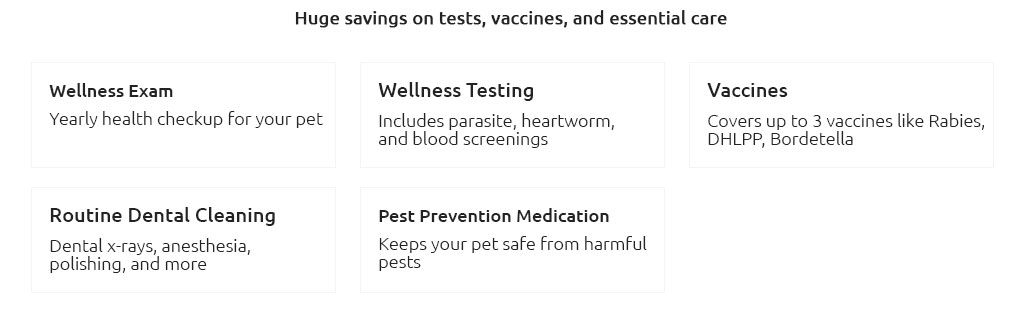

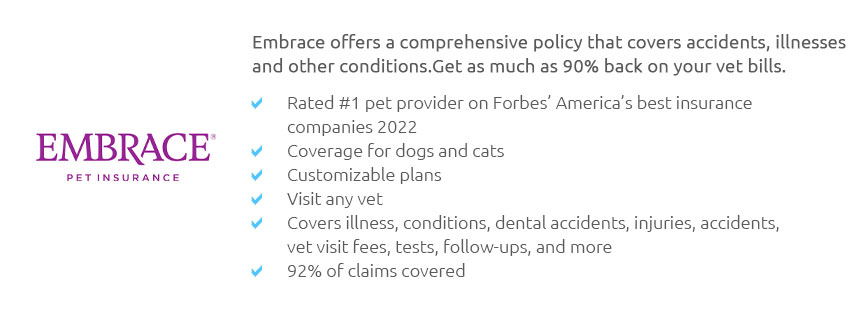

Health Insurance for Pets: What to ExpectIn recent years, the concept of health insurance for pets has gradually shifted from being an unfamiliar luxury to becoming a pragmatic necessity for pet owners across the globe. As veterinary care advances, so do the costs associated with it, making pet insurance a topic worthy of consideration for any responsible pet owner. This article seeks to shed light on what one can expect when embarking on the journey of securing health insurance for their beloved furry companions, while subtly navigating the intricate nuances of this burgeoning field. Firstly, it is imperative to acknowledge the myriad of reasons why pet insurance has gained traction in today's society. With the rise in advanced veterinary procedures and treatments, the financial burden on pet owners can be substantial. Pet insurance, therefore, serves as a safety net, offering peace of mind in times of unforeseen medical emergencies. However, understanding what pet insurance entails and what it does not cover is crucial to avoid future disillusionment. When contemplating pet insurance, one should expect a variety of plans tailored to meet diverse needs. These typically range from basic accident coverage to comprehensive plans that encompass accidents, illnesses, and wellness care. It is essential to conduct thorough research and compare various insurance providers, as the scope and cost of coverage can vary significantly. One should also be prepared to encounter exclusions and waiting periods, which are common across most insurance policies. Conditions such as pre-existing ailments are usually excluded, making it imperative to insure pets at a young age. Moreover, the financial aspect of pet insurance requires careful consideration. Monthly premiums can vary based on factors such as the pet's age, breed, and location. While some may view these premiums as an added expense, it is often a worthwhile investment in the long run, potentially saving owners from exorbitant veterinary bills. It is advisable to scrutinize the fine print, paying attention to details such as deductibles, co-pays, and reimbursement levels. Customer service and the claims process are also pivotal factors to consider when selecting a pet insurance provider. Opt for companies renowned for their prompt and hassle-free claims handling, as a cumbersome process can add unnecessary stress during critical times. Online reviews and testimonials can offer valuable insights into the experiences of fellow pet owners, guiding one towards a trustworthy insurer.

In conclusion, while pet insurance is not a one-size-fits-all solution, it certainly offers a valuable safety net, providing financial relief and enabling pet owners to make informed decisions regarding their pet's health. As one navigates the landscape of pet insurance, it is beneficial to remain informed and discerning, ultimately selecting a plan that aligns with both the pet's healthcare needs and the owner's financial capacity. As our pets continue to enrich our lives with unconditional love and companionship, securing their health and well-being through insurance is a step towards reciprocating that love in the most responsible manner possible. https://www.petinsurancequotes.com/pet-insurance/puerto-rico/

The bad news is there is only one pet insurance provider that offers coverage for dogs and cats in Puerto Rico. The good news is that Trupanion provider is one ... https://www.mapfre.pr/en/property-insurance/pets/

The animal has to be a cat or a dog and be in good health, without any physical ... https://benefits.petsmart.com/us/discounts-and-offerings/pet-insurance/

Plus, with the MetLife Pet mobile app, you can manage your pet's health and ...

|